Greg Harrison

B.Bus, Dip S.Dev, MBA,CA

Profile

Hi, I am Greg Harrison, CA, Entrepreneur and Author.

I have developed skills over a long career that allow me to be a problem solver and value creator.

My work experience has covered a range of industries;

- Oenology & Viticulture

- Transport

- Manufacturing

- Import/Export

- Fashion

- Hospitality and Hotels

- Lagre Scale (Stadium Level) Event management

- Tech startups (both clients and my own)

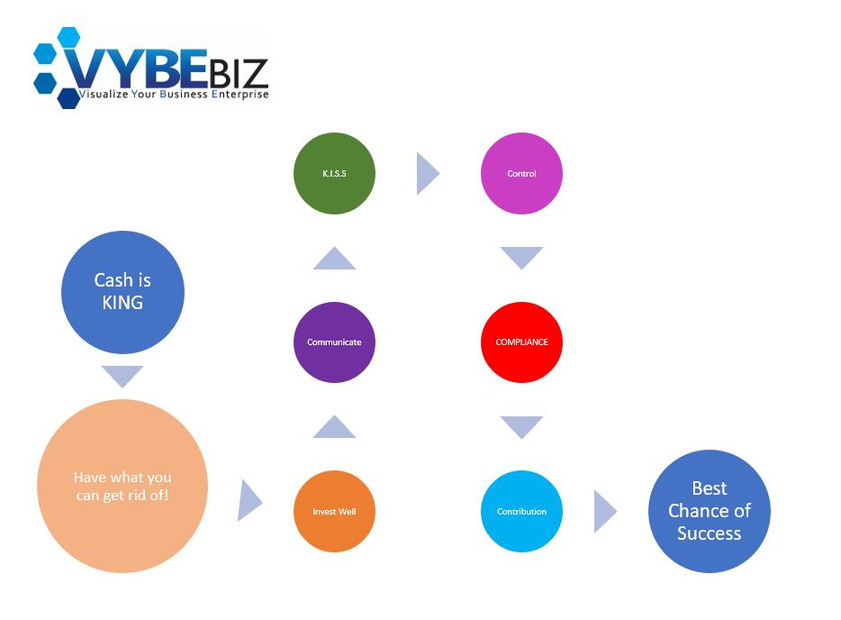

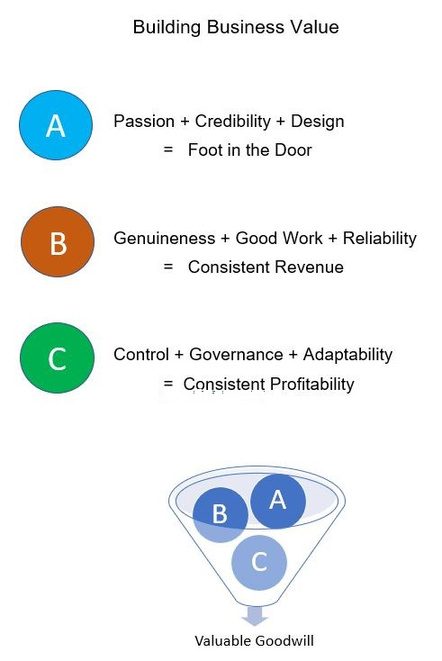

I have distilled all this experience into my own program which I use to assist clients in looking at their business in a new way, with the emphasis on finding the gaps or bottle necks that create revenue/profit leaks or impediments to growth. It is called the C.H.I.C.K 3C’s approach.

- Cash is King

- Have what you can get rid of

- Invest well

- Communicate & Communicate again

- Keep it simple stupid

- Control

- Compliance

- Contribution

Inevitably it will be one of the above areas stopping you achieving your goals. I work from home for a small number of clients at any given time which allows me to have a competitive fixed price fee structure. You will undoubtedly get a more personalised attentive service that delivers more.

Reach out to me for a free initial consultation.

I can also be reached through copperfox.org

Services

Virtual CFO

Our virtual CFO service offers a tailored approach to your financial needs, providing comprehensive insights and strategic guidance that is responsive and reliable. Not all business require or can afford a full time CFO or FC but still need this guidance “on tap”, often to be the “adult” in the room to ensure your KPI’s are right and governance is being done correctly.

Startups

Having successfully created our own startups as well as advised on many others we have the expertise to assist you to create the roadmaps to ensure you have the right road map in place to efficiently grow your business.

Forensics

Do you ever feel your numbers are not quite adding up, or you have that gut feeling that something isn’t quite right? Then as with all things in life, trust your gut feeling, even if it is to get peace of mind. Having studied forensic accounting and even written a novel on the subject, we can take a closer look at your books and systems to see if in fact anything is not right.

Due Dilligence and Valuations

Looking at acquiring a new business or need a valuation, that is our speciality. Let us kick the tyres of the business or provide you with a valuation of your existing business so that you can conduct negotiations and not leave money on the table.

Business Intelligence & Data Insights

We are experts in Excel, Power BI nd AI. Our skills in data preparation, analysis and presentation can ensure you are getting the most out of your data.

Costings & Variance Analysis

When was the last time you updated your costings or analyzed your actual margins and breakeven point. Do you know your contribution margins, average costs, marginal costs, labour efficiencies, wastage statistics? All these things are key to making effective business decisions. These are practical KPIs we can put in place to ensure your business is as efficient as possible.

Staging Your Business

When it comes time to think about exiting your business, it will need to be staged in its best light, much like staging a home for sale. We can prepare a package that includes any or all of the following;

- Writing a brochure telling the story of your business and highlighting its growth

- Systemising any part of your business so that it appears less reliant on your input as an owner operator.

- Preparing a due dilligence report to ensure any issues that could reduce the sale price are identified and rectified

- Value the business

- Working with the business broker and potential purchasers to ensure the smooth transition of ownership.

We have expertise in the Microsoft tech stack and AI products

Our Week Long Intensive Review Engagement Programme

Title: The Importance of Regular Forensic Accounting Checks to Prevent Business Fraud

As a business owner, safeguarding your company from fraud is paramount. Fraud can take many forms, from misappropriation of funds to manipulating financial statements, and it often goes undetected until it's too late. One of the most effective ways to mitigate this risk is by conducting regular forensic accounting checks. These checks are essential for ensuring the accuracy of your financial records and can identify red flags that may indicate fraudulent activity.

Our week long engagement encompasses the following programme and produces a comprehensive report on the findings.

Here’s a breakdown of key forensic accounting tests that should be regularly undertaken and why they are crucial for your business:

1. Payables Statement Balances to Payments

- What it is: This check involves comparing your payable statement balances with the actual payments made.

- Why it matters: Discrepancies between these records could indicate unauthorized or inflated payments, signaling potential fraud.

2. Payables Bank Accounts to Actual Payment Advices

- What it is: This involves verifying that payments recorded in your payables bank accounts match the payment advices issued.

- Why it matters: Ensuring these match can prevent fraudulent diversion of funds, where payments are recorded but never actually sent to the intended recipient.

3. Payables Payments Made vs Payments Recorded on Creditors' Statements

- What it is: This test compares the payments your business has made with the payments recorded on your creditors’ statements.

- Why it matters: Mismatches here might indicate that payments have been manipulated, either inflated or fabricated, potentially hiding fraudulent transactions.

4. Bank Statement Payments

- What it is: This involves a thorough review of payments made through your bank accounts.

- Why it matters: Regularly auditing bank statement payments helps to ensure that all outgoing funds are legitimate and accounted for, reducing the risk of unauthorized transactions.

5. Receivable Credits Processed

- What it is: This check ensures that credits applied to receivables are valid and correctly processed.

- Why it matters: Invalid credits could be used to conceal theft or embezzlement, making it vital to verify that all credits are legitimate.

6. Inventory Adjustments

- What it is: This involves reviewing adjustments made to inventory records.

- Why it matters: Unauthorized inventory adjustments could be a way to hide theft of physical assets, making this an essential area to monitor.

7. General Ledger Journals

- What it is: Examining the entries in your general ledger for any unusual or suspicious activity.

- Why it matters: The general ledger is the backbone of your financial records. Irregular entries could indicate attempts to conceal fraud.

8. Fixed Asset Write-Offs and Existence Checks

- What it is: This check ensures that fixed asset write-offs are justified and that the assets still exist and are in use.

- Why it matters: Fraudulent write-offs can be used to cover up theft or the misappropriation of assets, making these checks critical to maintaining accurate asset records.

9. Payroll Bank Accounts vs Payable Bank Accounts

- What it is: Comparing payroll bank accounts with the accounts used to pay other liabilities.

- Why it matters: This ensures that payroll funds are not being misappropriated or diverted for unauthorized purposes.

10. Payroll Hours Paid

- What it is: Verifying that the hours paid match the hours worked as per timesheets.

- Why it matters: Overpayment or payment for non-existent hours is a common form of payroll fraud. This check helps to ensure payroll accuracy.

11. Companies Office Check of Staff vs Creditors

- What it is: Comparing your staff records with your creditor records to identify any unauthorized entities receiving payments.

- Why it matters: This helps to prevent fraud where non-existent or fake staff members are set up as creditors to siphon off funds.

The Case for Regular, Independent Audits

Even the most vigilant business owner can miss signs of fraud. This is why it’s critical to have these checks performed regularly and, ideally, by an independent forensic accounting expert. An independent expert brings a fresh, unbiased perspective and is trained to spot anomalies that might otherwise go unnoticed. Regular audits not only help in early detection of fraud but also act as a deterrent to those who might consider engaging in fraudulent activities.

In conclusion, by implementing these forensic accounting checks and ensuring they are conducted by an independent expert, you can significantly reduce the risk of fraud in your business, protecting your assets and maintaining the integrity of your financial records.

Cost of above 1 week programme - $6,250 +GST

Our Fees

Fees

For one off projects we will negotiate a fixed fee, 50% upfront, 50% on completion.

For our monthly vCFO service we will negotiate a fixed monthly subscription payable using our payments partner - GoCardless

Who we help.

SME

We have extensive experience working with SME owners

E-Commerce

We do E-Commerce ourselves and know the issues

Startups

We have built startups from scratch and have walked the walk.

Our Business Models

The above models are the tried and tested frameworks used to create value in your business

Why CFO Shark? We embody the spirit of the agile and relentless shark, navigating the financial seas with precision and speed. Our team of financial experts ensures that your business sails smoothly, adapting swiftly to changing tides and seizing opportunities. Whether it’s financial strategy, risk management, or operational efficiency, CFOShark is your trusted partner in achieving financial excellence. 🦈💼🌊

CFO Shark - You Tube Channel

Client Reviews

I have known Greg for many years, and still his ability to grasp complex scenarios and break them down into simple concepts amazes me. His skills in developing systems and solutions to enhance the productivity and reporting capabilities is a skill that makes Gregory an asset to any organisation. Greg's personality and smile always has a way of making my most stress filled days seem easier.

Gary Christieson - Director

Greg has been our advisor for a number of years and has advised on a number of projects, both business and personal. He is extremely knowledgeable and can explain things simply. His calling card is his responsiveness and ability to get results.

Richard Warburton - Director

I have known Greg for nearly 5 years. I was first introduced to Greg through one of his companies that I later became part of. While initially I understood Greg to have exceptional financial management skills and experience I quickly also learnt Greg entrepreneurial skills and drive, his understanding of how to bring a product from idea to inception, how to bring a team together with financial, development and sales knowledge behind his idea and onto the same page. It has been an honour working with Greg and to continue to see him delivery his knowledge and experience to many recipients.

Andrew McClurg - General Manager APAC

CW Automotive was the first step into business ownership for myself

and my wife. Greg was instrumental in every step of the process from due dilligence, to purchasing the business, to setting up our systems and establishing our business plan. He made what was a daunting and stressful decision into a paint by numbers excericse. His calm and patient manner and ability to explain difficult business concepts made the transition from employee to owner effortless.

Callum Williams - Owner/Director

Mailing Address

PO Box 26156 Epsom Auckland 1344

New Zealand

Phone Number

+64-27-4384023

Email Address

gregmhnz@gmail.com

Vybebiz Limited

PO Box 26156

Epsom, Auckland 1344

New Zealand

Copyright 2024 Vybebiz Limited

Email : gregmhnz@gmail.com

Privacy

VYBEBIZ, is committed to protecting your privacy and understand you wish to have your personal information kept secure. We appreciate the fact that we collect and hold a large range of highly sensitive information in our role as your virtual CFO. Accordingly, we maintain our commitment to adhere to the National Privacy Principles and any applicable laws, regulations, codes etc. when collecting, using, disclosing, securing and providing access to personal information.

Collection of your personal information

There are many aspects of the site which can be viewed without providing personal information, however, for access to the VYBEBIZ service, we are required to collect only personal information that is relevant and necessary in providing the services have requested from us.

Generally, VYBEBIZ may collect any of (but not necessarily all of or limited to) the following information about you:

• Name

• Date of Birth

• Postal & Business Addresses

• Email Address

• NZBN

• Telephone & Fax Numbers

• ACN

• Account & Business Records

• Bank Account Details

• Business Associate Details

The law does not require us to collect personal information about you, however, if you do not provide us with the relevant information, we will not be able to adequately provide you with the services you require.

Sharing of your personal information

We may occasionally hire other contractors to provide services on our behalf, including but not limited to handling customer support enquiries and transaction processing and management. Those companies will be permitted to obtain only the personal information they need to deliver the service. VYBEBIZ takes reasonable steps to ensure that these organisations are bound by confidentiality and privacy obligations in relation to the protection of your personal information.

Use of your personal information

We collect this information to allow us to provide only virtual CFO services as you have requested from us.

From time to time, we may use customer information for new, unanticipated uses not previously disclosed in our privacy notice. If our information practices change at some time in the future we will use for these new purposes only, data collected from the time of the policy change forward will adhere to our updated practices.

We will not disclose information about you to any third parties unless the disclosure:

• Is necessary for a service you have requested (eg to the NZ Companies Office for company incorporations);

• Is required by law;

• Is authorised by law;

• You have provided consent for us to disclose the information about you.

Changes to this Privacy Policy

VYBEBIZ reserves the right to make amendments to this Privacy Policy at any time. If you have objections to the Privacy Policy, you should not access or use the Site.

Accessing Your Personal Information

You have a right to access your personal information, subject to exceptions allowed by law. If you would like to do so, please let us know. You may be required to put your request in writing for security reasons. VYBEBIZ reserves the right to charge a fee for searching for, and providing access to, your information on a per request basis.

Contacting us

VYBEBIZ welcomes your comments regarding this Privacy Policy. If you have any questions about this Privacy Policy and would like further information, please contact us by any of the following means.

Post:

Attn: Privacy Policy

VYBEBIZ Ltd

PO Box 26156

Epsom, Auckland 1344

New Zealand

E-mail: gregmhnz@gmail.com